Table of Contents

- Key Takeaways

- What Is Asset-Based Lending?

- What Is Asset Finance?

- How Are They Different?

- Industry Examples

- What Are the Good and Bad Things About Each?

- Which One Should You Choose?

- Frequently Asked Questions (FAQs)

Key Takeaways

- Asset-Based Lending (ABL) gives you cash by borrowing against what you already own,like unpaid invoices or equipment.

- Asset Finance helps you buy or lease new equipment, vehicles, or tools and spread the payments over time.

- Businesses in manufacturing, logistics, and construction often use both, depending on their needs.

- Choose based on what you need: cash now, or new tools for future work.

What Is Asset-Based Lending?

Asset-Based Lending is when you use things your business already owns to get a loan or credit. These things, called assets, will include what is mentioned below:

- Invoices from customers who haven’t paid yet

- Stock or inventory

- Tools, machines, or vehicles

- Property or land

You still keep your assets; you’re just using their value to borrow money. This helps when you’re waiting to get paid or need fast access to cash.

Why Use It?

- Helps with cash flow

- Pays bills while waiting for income

- Grows as your business grows

- Fast and flexible funding

What Is Asset Finance?

Asset Finance is a way to buy or use business equipment without paying the full cost upfront. Instead, you make monthly payments. This helps you manage cash better while still getting the tools you need.

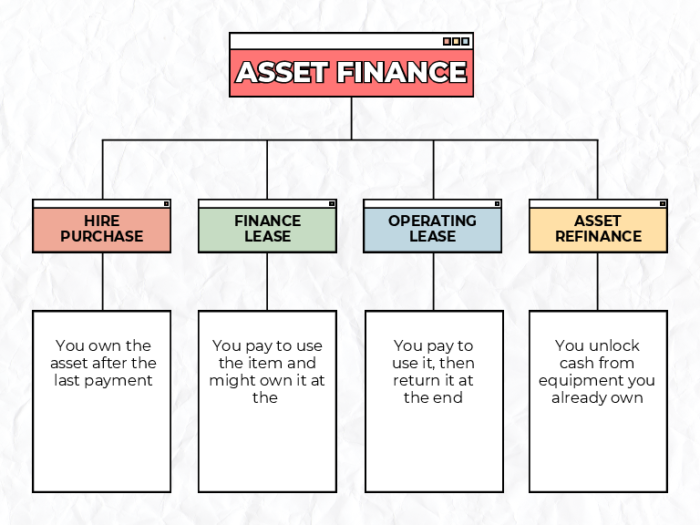

Asset Finance – Umbrella

Asset Finance is funding used to buy or refinance tangible business assets,things like machines, vans, or tools.

Fig. 1

The above image does not, however, indicate all the services that fall under the umbrella of Asset Finance. Contact us to learn more!

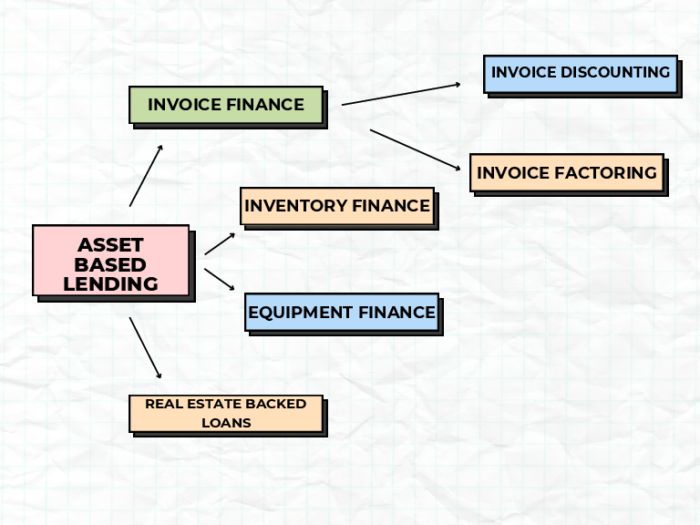

Asset-Based Lending (ABL) – Umbrella

Lending secured against assets already owned by the business.

Fig. 2

Asset Finance is about getting or refinancing assets

Asset-Based Lending is about borrowing money against owned assets

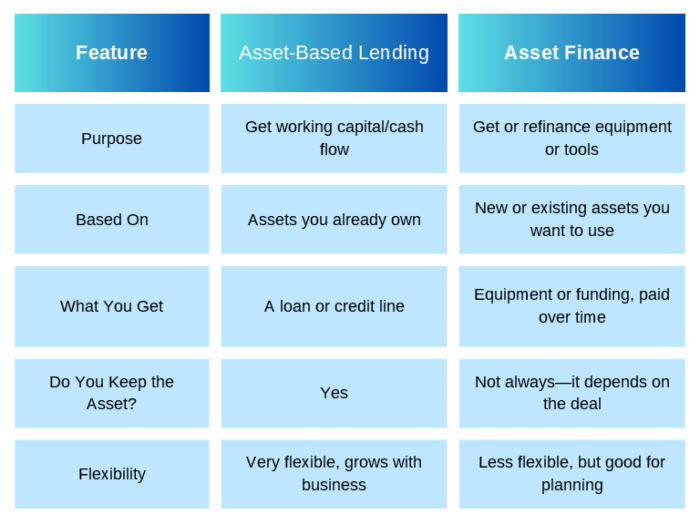

How Are They Different?

Even though both involve business assets, they work in different ways.

Fig. 3

What Kinds of Assets Can Be Used?

To get Asset-Based Lending or Asset Finance, your business needs to have assets. But what does that mean?

An asset is something your business owns or uses that has value. You can either borrow money using it (Asset-Based Lending) or use finance to get it (Asset Finance). Here are the most common kinds:

Unpaid Invoices (used for ABL)

If your customers haven’t paid you yet, those unpaid bills are worth money. Lenders can give you cash now based on those invoices.

Machines and Equipment

- Welding machines

- Printing presses

- Excavators or cranes

- Factory tools

These can be used to borrow money (Asset Refinance) financed through monthly payments (Asset Finance)

Vehicles

Any business vehicles may count, like:

- Delivery vans

- HGVs or trucks

- Forklifts

- Company cars

You can finance new ones or refinance old ones to get cash out.

Stock and Inventory

If you make or sell products, the items sitting in your warehouse or shop can be used for borrowing under Asset-Based Lending.

Property or Land

If your business owns a building or land, this can be used in some Asset-Based Lending deals or refinanced to free up cash.

Industry Examples

Manufacturing Company Example

A busy manufacturing company makes parts for large machines. Business is good, but there’s a big problem: they have to wait 60 days to get paid by their customers. That means they’re often short on cash, even though they’re doing lots of work.

Problem #1: Not enough cash while waiting for payment

The solution? Asset-Based Lending.

They borrow money using their unpaid invoices. This gives them quick cash to cover bills, buy materials, and pay staff,without waiting two months for the customer to pay.

Problem #2: Need a new machine to take on bigger jobs

They don’t have the money to buy it upfront. So they use Asset Finance to get the machine they need and spread the payments over time. Now they can grow their business without breaking the bank.

Logistics Company Example

A growing logistics company is picking up more delivery jobs across the country. But now they face two big challenges.

Problem #1: They need 10 new delivery vans,fast.

Buying them all at once would cost too much. The answer? Asset Finance.

Instead of paying upfront, they lease the vans. This means they get the vehicles right away and pay in monthly amounts that fit their budget.

Problem #2: A big customer hasn’t paid yet.

They’re owed a lot of money but can’t wait another 30 days. So they use Asset-Based Lending to get money now using that unpaid invoice.

This gives them the cash to pay drivers, fuel the vans, and keep deliveries moving.

Construction Company Example

A construction company has just landed a big building project. That’s great news,but there’s a catch: they won’t get paid for three months. In the meantime, they still need to pay workers, buy materials, and rent equipment.

Problem #1: Not enough cash during the project

They turn to Asset-Based Lending and borrow money using the value of equipment they already own,like diggers and trucks. This gives them the cash flow they need to keep the job running smoothly.

Problem #2: They need a crane to complete part of the build

Instead of spending a huge amount upfront, they use Asset Finance to pay for the crane over time. That way, they get what they need now and spread the cost across several months.

What Are the Good and Bad Things About Each?

Asset-Based Lending

Pros:

- Fast cash

- Helps manage ups and downs in income

- Grows with your business

- Keeps you in control of your assets

Cons:

- Must have strong assets

- May require checks or paperwork

- Not ideal for very small businesses

Asset Finance

Pros:

- Makes big purchases easier

- Helps with planning

- Can bring tax benefits

- You get what you need right away

Cons:

- You may not own the asset

- Long-term cost can be higher

- Less flexible than ABL

Which One Should You Choose?

If you need money to pay bills or wages, then Asset-Based Lending can help you get fast cash from the assets you already have. When you want to buy new tools, machines, or trucks, then Asset Finance is the better choice because it lets you spread the cost over time.

Do you already own equipment but need extra cash? Then Asset Refinance (a type of Asset Finance) can release money tied up in those assets. If you’re waiting to get paid for a big job, Asset-Based Lending can give you the money now, even before the customer pays you. And if you want to grow your business without spending a lot upfront, then Asset Finance helps you get the things you need without using all your cash at once.

Trusted by Businesses for 20 Years

For the past 20 years, MacManus Asset Finance has helped businesses like yours. From family-run construction firms to large-scale manufacturers, we help solve real problems with smart finance solutions.

We’re proud to say our commitment hasn’t gone unnoticed.

- In 2024, we were honoured as a Multi-Awarded Broker at the Business Moneyfacts Awards, one of the most respected events in the industry.

- In 2025, we were also Commended for our continued service, integrity, and client-first approach.

Either it’s Asset Finance to get new equipment or Asset-Based Lending to unlock cash from invoices, we’ve supported clients in manufacturing, logistics, and construction and many more.

Want to see how it works in real life?

Take a look at our case studies, where real companies share how they used these finance options to overcome challenges and grow.

Frequently Asked Questions

Q: Can a small business use these options?

A: Yes, though ABL works better if you have invoices or assets to borrow against. Asset Finance can be used by businesses of all sizes.

Q: Do I keep ownership of my assets?

A: With ABL, yes. With Asset Finance, it depends,some deals let you own the item at the end, others don’t.

Q: Can I use both at once?

A: Yes! Many companies use ABL for working capital and Asset Finance to get the tools they need.

Q: How fast can I get funds?

A: ABL can be very quick,sometimes in a few days. Asset Finance can also be fast if your application is ready.

Q: Are these better than bank loans?

A: For many businesses, yes. They’re more flexible and based on your assets, not just your credit score.