York Business Finance | Built Around Growth

In York, companies can use York finance to move ahead with plans, hire more help, or manage payments while growing.

5-star Excellent Service

York Firms Turn to Business Funding to Deal with Supplier Bills, Seasonal Demand, and Cash Gaps

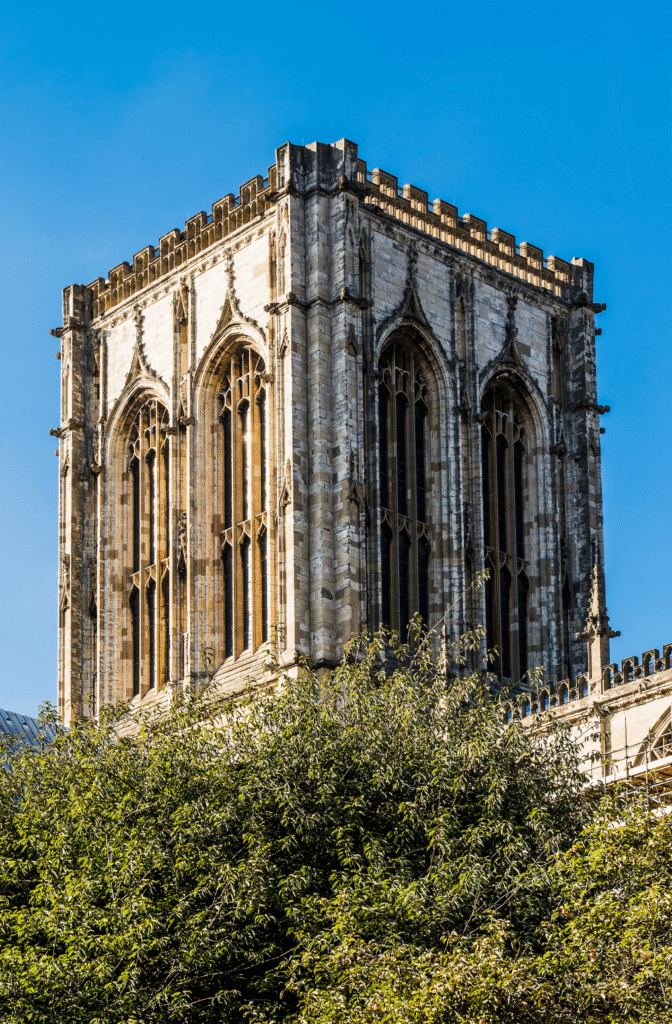

York is a vibrant city built on history and driven by modern enterprise — with a strong base in tourism, construction, hospitality, and professional services. Whether you’re a contractor in Acomb, a growing firm in Clifton Moor, or a boutique business in the city centre, the right York business loans or finance can give you more freedom to act.

Supporting York SMEs Across the Region

From historic trades to high-growth start-ups, York businesses are diverse — and so is our approach to funding. We’ll help you find the right lender and structure to match your ambition and sector.

Let’s unlock flexible finance for your York business — and support your next step forward.

What We Finance in York

Efficient Finance Solutions That Work for You

Why Choose Us

experience premium financial services

Over 20 Years in

Asset Finance

Competitive Rates &

Flexible Terms

Business-Focused

Solutions

Fast Application &

Approval Process

Award-winning

Asset Finance Broker

Ready to fuel your York

Business Growth?

Contact us to discover why we’re York’s trusted business finance partner.

Frequently Asked Questions

Yes, we help local businesses in the tourism, hospitality, and heritage sectors access funding for renovations, equipment, and seasonal cash flow.

Yes, we support firms in surrounding areas like Haxby, Fulford, and Acomb with the same range of tailored financial solutions.

Absolutely. Our VAT loans let you spread out tax payments and keep more working capital available during key times.