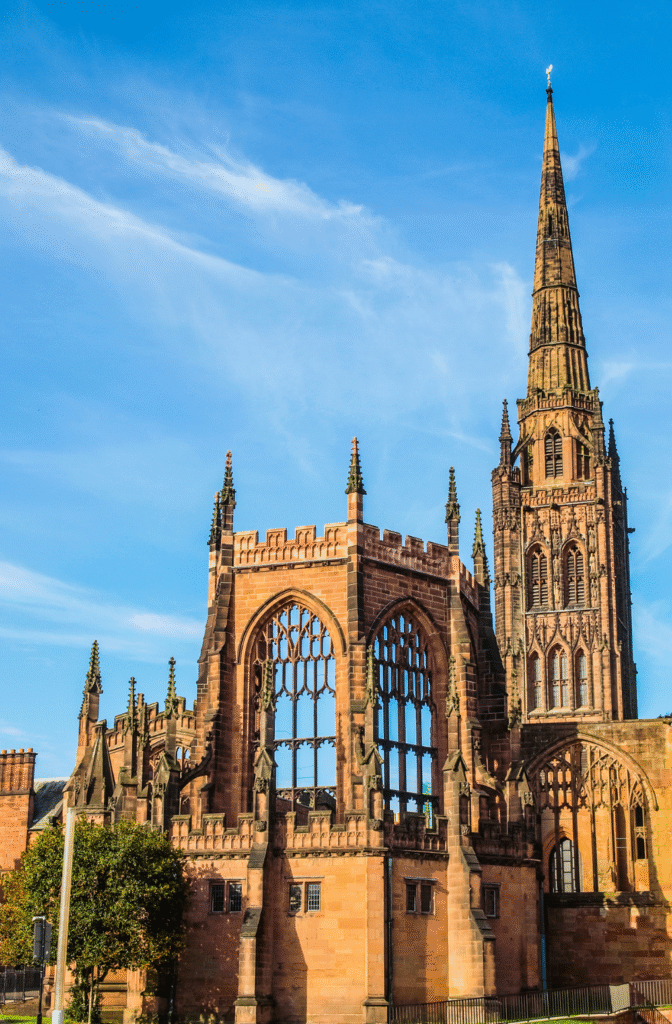

Coventry Business Finance | Backing Ambitious Growth

Access Coventry finance solutions for SMEs, offering flexible loans, equipment funding, and tailored support for local business growth.

5-star Excellent Service

Coventry Companies Turn to Finance to Hire Staff, Buy Equipment, and Manage Seasonal Gaps

Coventry sits at the heart of British industry, with strength in automotive, engineering, and professional services. Whether you’re an advanced manufacturer near Ansty Park, a consultancy firm in Earlsdon, or a builder working across Warwickshire, the right Coventry finance solution helps you grow without overstretching.

Coventry SMEs and businesses across the West Midlands can access flexible finance solutions tailored to their growth needs. From bridging cashflow gaps and supporting payroll to funding equipment, vehicles, and expansion projects, our Coventry business finance options help companies of all sizes achieve their goals with speed and confidence.

Supporting Coventry SMEs Across the Region

From established firms in Tile Hill to scale-ups around the Ring Road, our lending network is built to support Coventry’s unique business mix. Fast, flexible, and always personal — that’s how we help Coventry SMEs and Coventry companies access the finance they need to succeed.

What We Finance in Coventry

Efficient Finance Solutions That Work for You

Why Choose Us

experience premium financial services

Over 20 Years in

Asset Finance

Competitive Rates &

Flexible Terms

Business-Focused

Solutions

Fast Application &

Approval Process

Award-winning

Asset Finance Broker

Ready to fuel your Coventry

Business Growth?

Contact us to discover why we’re Coventry’s trusted business finance partner.

Frequently Asked Questions

We provide asset finance, invoice finance, VAT loans, business loans, and high-end car finance for directors and professionals.

Yes, we have extensive experience funding businesses across Coventry’s automotive supply chain and advanced manufacturing firms.

Yes, we work with lenders who support start-ups and early-stage companies with the right financial foundations.

We can arrange short-term business loans or invoice finance to help with immediate cash flow needs.

Yes, we support accountants, consultants, legal practices, and healthcare businesses with a range of funding options.