Huddersfield Business Finance That Works for You

Huddersfield companies can access finance for upgrades, staff costs, or buying equipment needed to keep up with demand.

5-star Excellent Service

Huddersfield Firms Use Straightforward Finance to Manage Costs and Deliver Consistently

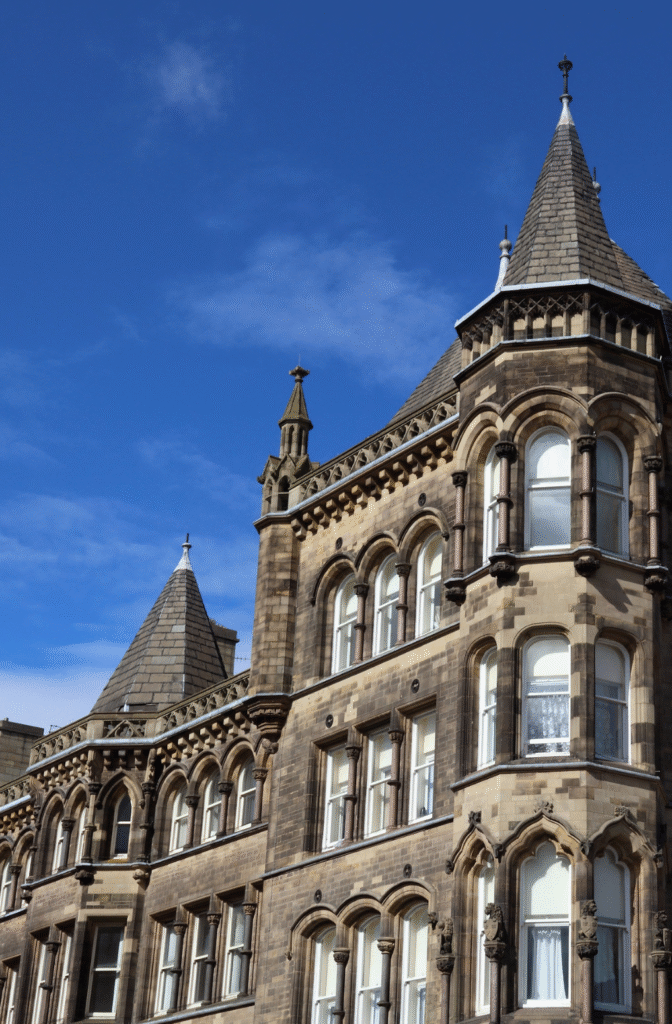

Huddersfield has a strong foundation in manufacturing, construction, logistics, and B2B services — with a growing number of ambitious SMEs driving the town forward. Whether you’re a subcontractor in Lindley, a haulage operator in Deighton, or a specialist supplier in Honley, access to the right finance can keep your plans moving.

Huddersfield companies can access flexible finance solutions tailored to their needs, from covering everyday costs to funding growth. Explore our options below to see how Huddersfield business loans, asset finance, VAT loans, and other solutions can support your SME.

Supporting Huddersfield SMEs Across the Region

Whether you’re based in an industrial unit in Bradley or an office in the town centre, we take time to understand your business and connect you with lenders who know your industry. Discover tailored Huddersfield finance options to support growth and keep your business moving.

What We Finance in Huddersfield

Efficient Finance Solutions That Work for You

Why Choose Us

experience premium financial services

Over 20 Years in

Asset Finance

Competitive Rates &

Flexible Terms

Business-Focused

Solutions

Fast Application &

Approval Process

Award-winning

Asset Finance Broker

Ready to fuel your

Huddersfield Business Growth?

Contact us to discover why we’re Huddersfield’s trusted business finance partner.

Frequently Asked Questions

Yes, we support Huddersfield’s manufacturing base—including textiles and engineering—with funding for equipment, vehicles, and production lines.

Absolutely. We offer business loans and VAT finance for retailers, cafés, and hospitality venues across the town.

Yes, we help businesses fund everything from single work vans to multi-vehicle fleets for delivery or trade use.